Table of Contents

- How to File a Tax Extension - Resources and Instructions

- Every major tax deadline in 2025

- Tax Extension Form - Cam Noelani

- Tax Day: How to file an extension on your 2020 federal income tax ...

- File Extension Taxes 2025 Free Pdf - Sophia M. Gaertner

- Tax extension: The October deadline for filing your return is almost ...

- 2018 Deadline for Federal Income Tax Extension Approaching - Joshua ...

- Tax extension grunge rubber stamp on white background, vector ...

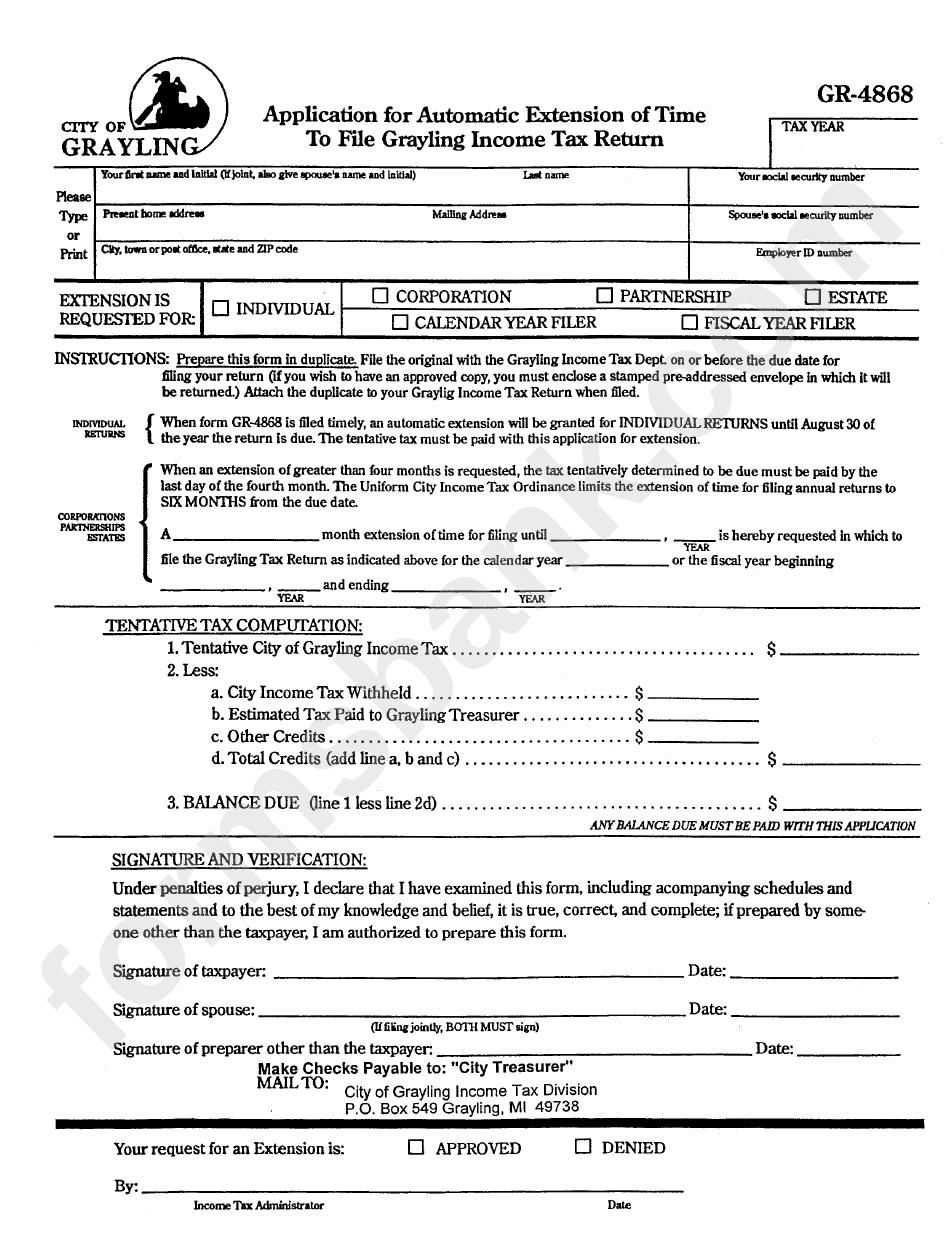

- Printable Tax Extension Form

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

What is IRS Free File?

Why File an Extension?

How to File an Extension through IRS Free File

Filing an extension through IRS Free File is a straightforward process. Here are the steps you need to follow: 1. Check your eligibility: Make sure you meet the eligibility requirements for IRS Free File, which include earning $69,000 or less per year. 2. Visit the IRS website: Go to the IRS website at www.irs.gov and click on the "Free File" tab. 3. Choose a tax preparation software: Select a tax preparation software from one of the participating companies, such as TurboTax or H&R Block. 4. Prepare your tax return: Use the tax preparation software to prepare your tax return, but do not submit it. 5. File Form 4868: File Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, which will give you an automatic six-month extension. 6. Submit your extension: Submit your extension request through the tax preparation software, and you will receive a confirmation of receipt.